The Layman’s Interpretation of Web3 and Blockchain.

Some people scream “Bitcoin is king!” Others say “The future of web is [insert Ethereum, Cardano, Solana, or some other platform]!” What I see is a fledgling world that represents a pre-2000s mindset.

It’s impossible to mention “crypto”, “blockchain”, or some other term without a swarm of enthusiasts coming in to prove why their platform is better than the other. I get it, everyone loves to fight for what matters to them… what their version of the future looks like. Some people love to mention that investing into these technologies are comparable to investing into Amazon or Microsoft before they took off. I would argue it’s only easy to make that comparison in hindsight since we don’t actually know which blockchains and web3 utilities are going to make it into maturity. However, one thing I do know is that all the things surrounding web3, blockchain, and more are here to stay… and new dapps and utilities are being created on a daily basis. So let’s jump into what exactly is going on.

So what exactly is blockchain?

The best way I can describe the purpose of blockchain is through a scenario.

Image if you will… you’re a business selling a product. Customer A comes in and wants to buy the

product. The service

will cost $1,000 dollars. In a normal scenario, there’s a couple things to consider:

- Does the business actually have the product?

- Does the customer actually have the money?

- Once the customer gives the money, will the product actually be delivered?

- Does the product actually have what the business promises it has?

- If the business provides the product before payment, will the customer actually pay the business?

Then you might be thinking: “Well, if someone has these concerns wouldn’t they sign a contract?”

…Bingo

Essentially, blockchain aims to resolve these problems without the messiness of figuring out

what should be in the

contract. You might have heard the term “smart contracts” before… it’s essentially an instrument

that allows two parties

to engage in a transaction where technology will handle all the verification and details. What

you end up with is a

transaction that looks like this:

- Business is selling a product (Blockchain has a record of it).

- Customer wants to buy the product (Blockchain can verify the funds).

- Customer starts transaction (Smart contract formed).

- Business releases the product (Smart contract recognizes it).

- Business gets money, customer get product (Smart contract fulfills the promise simultaneously, resulting in delivery for both parties at once).

There are many details involved in the back-end that makes it actually work this way. However, the end goal is to make transactions faster and easier to complete. Technology then essentially serves as an intermediary instead of the two parties trying to hash it out themselves.

So how is this much different from how things are today?

Most transactions are handled by a singular being. What this means is that the process and timing of these transactions rely on the singular being and when/how they want to handle it. Blockchain aims to make these processes decentralized so not one single entity can hold up the speed of transactions. This is done by having multiple people, ways, and methods available to submit and validate the information coming into the blockchain. You might hear of them being referenced as validators, there are parties such as Chainlink that helps bring details/goods onto the blockchain.

Well, this all seems like stuff that doesn’t concern me at the moment..?

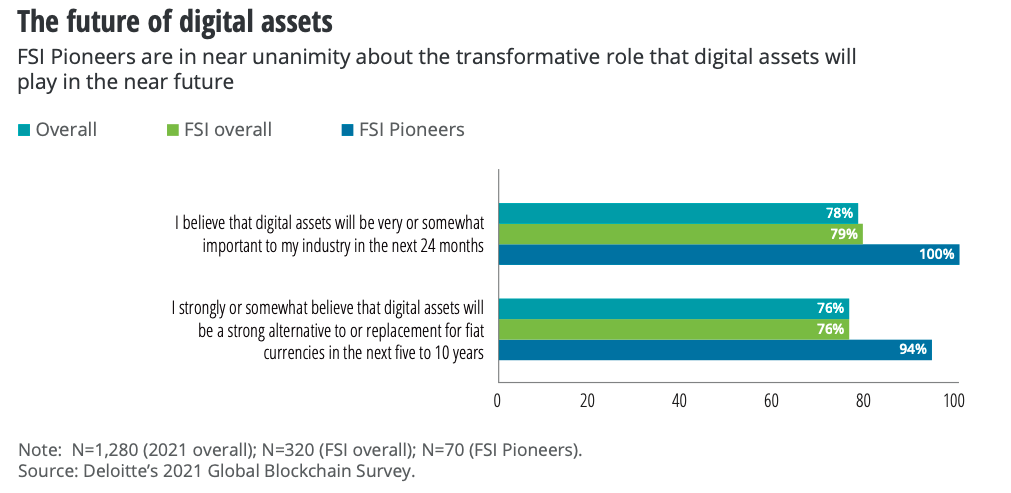

Blockchain is becoming a huge part of our everyday lives. Our good friends at Deloitte actually conducted a survey with professionals in the financial services industry and found that digital assets, i.e. things that would be found on the blockchain, will potentially be a strong alternative, or replacement, for fiat currencies. And it might all be happening within the next decade.

It feels like a pretty strong consensus. However, this could mean many things.

- The way you buy things are simply through digital means, such as using services like Apple Pay, Google Pay, NFC, etc.

- This all only applies to digital goods. Such as those NFTs that every crypto bro on Twitter is shilling.

However, it’s going to be much more than that…

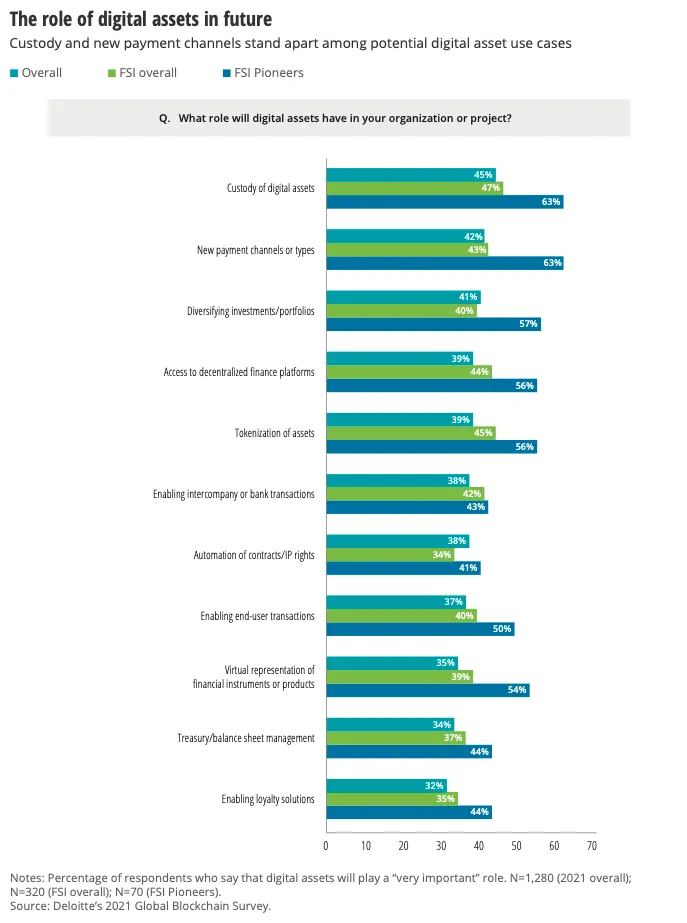

I would like to point out channels like “tokenization of assets”, “virtual representation of… products”, and “enabling loyalty solutions”… these are far beyond the ideas of blockchain primarly being used as a means of exchanging currency… unless our definition of currency is changing?

A new economy appears… and it’s called Web3.

I like thinking of Web3 as the next chapter of the economy. It’s essentially a future marketplace where goods and services can be easier to transact. Different forms of “currency” from the money we hold, to the things we own, and the information we can provide are all managed through one persona plus related digital tokens. These digital tokens can be accessed by others on the blockchain for numerous transaction types. For example:

- What if I could be paid for looking at ads that are relatable to me? There’s the Basic Attention Token for that.

- How can I make it easier for people to send me payments? Take a look at the Ethereum Name Service.

- How can I find stuff easier on the blockchain? The Graph is essentially being called the Google of Web3.

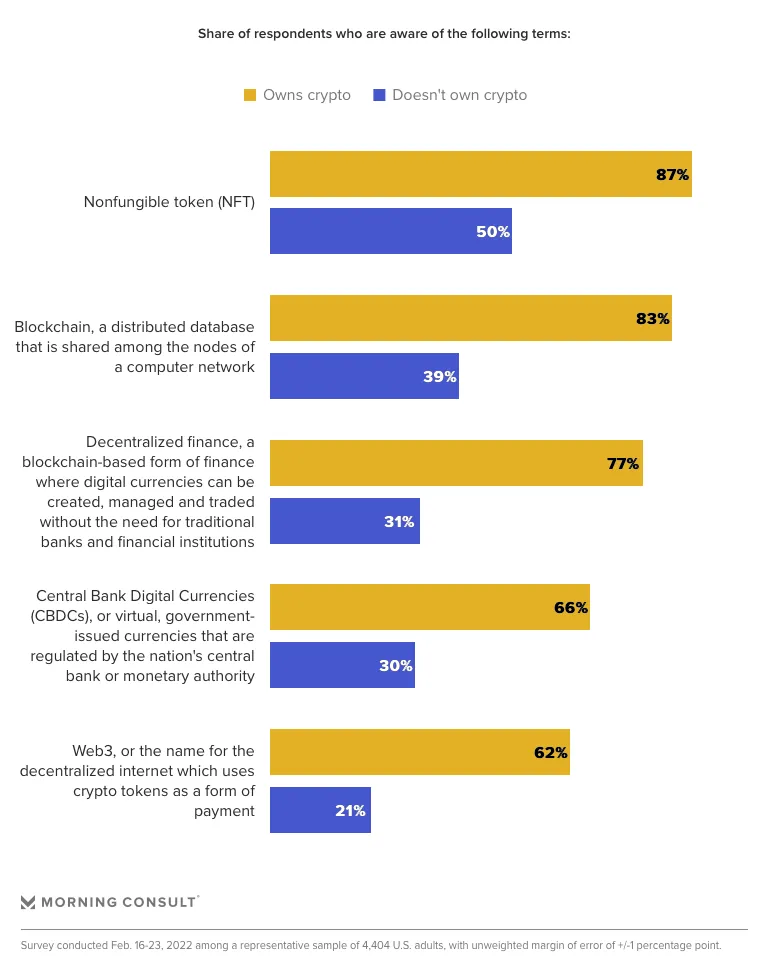

The future is starting to look towards more digital means of fulfillment. With that, it’s becoming increasingly important to bridge the divide we have between individuals that are online versus offline. There are plenty of individuals that are up to speed with all of this… but plenty more people that are not, according to a survey put together by Morning Consult:

So… what are the next steps from here?

The best thing you can do is start researching blockchain, web3, the different utilities that are out there, and what it all means for our future. There’s a lot of money and resources pouring into this sector, and a lot of players starting to compete for their own place. You also have institutions like JP Morgan, Facebook (Meta), Microsoft, and others looking at ways they can leverage blockchain for their offerings. You don’t necessarily have to go and buy different coins or tokens to get involved. I would start by looking at a combination of sources spanning from Bloomberg and CNBC, to newer outlets like CoinDesk and Cointelegraph. It can be easy to trap yourself into a particular mindset if you seek information from one source… so I would highly recommend seeking information across the whole spectrum.

Did you find this article helpful?

Subscribe to The Download and get updates on when new articles come out.